Investor Services

Capital and Shareholder Structure

Capital and Shareholder Structure

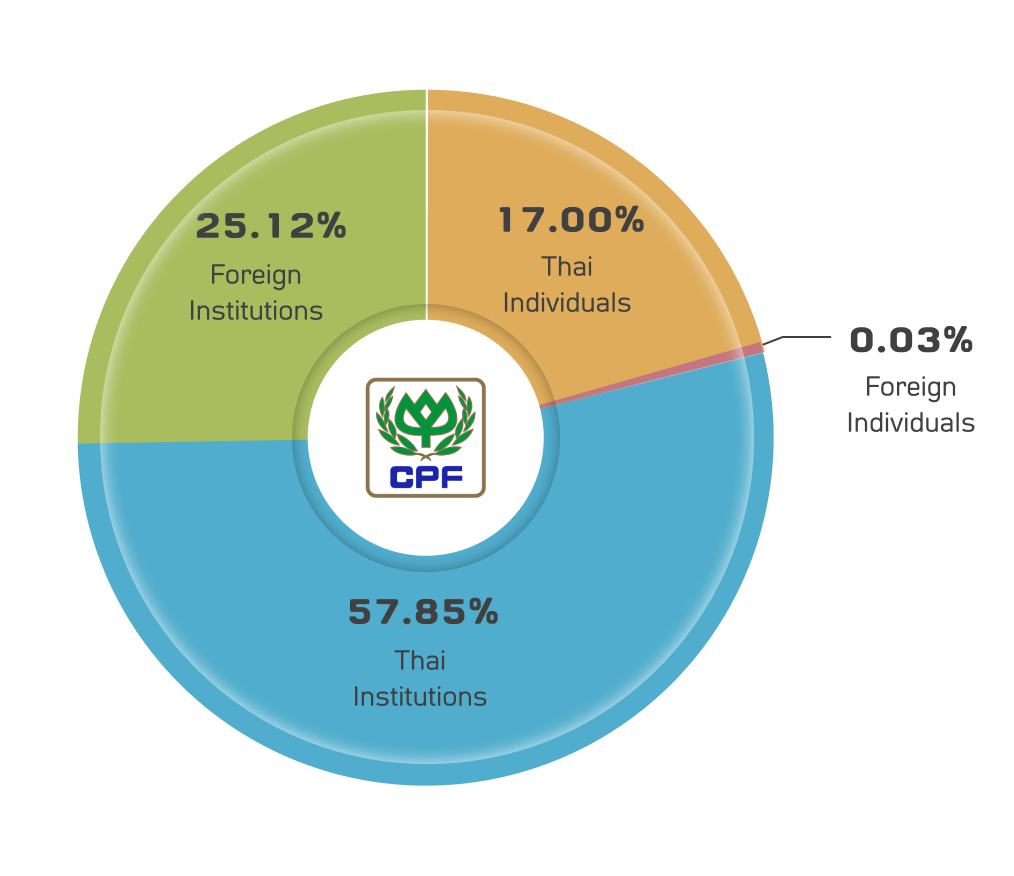

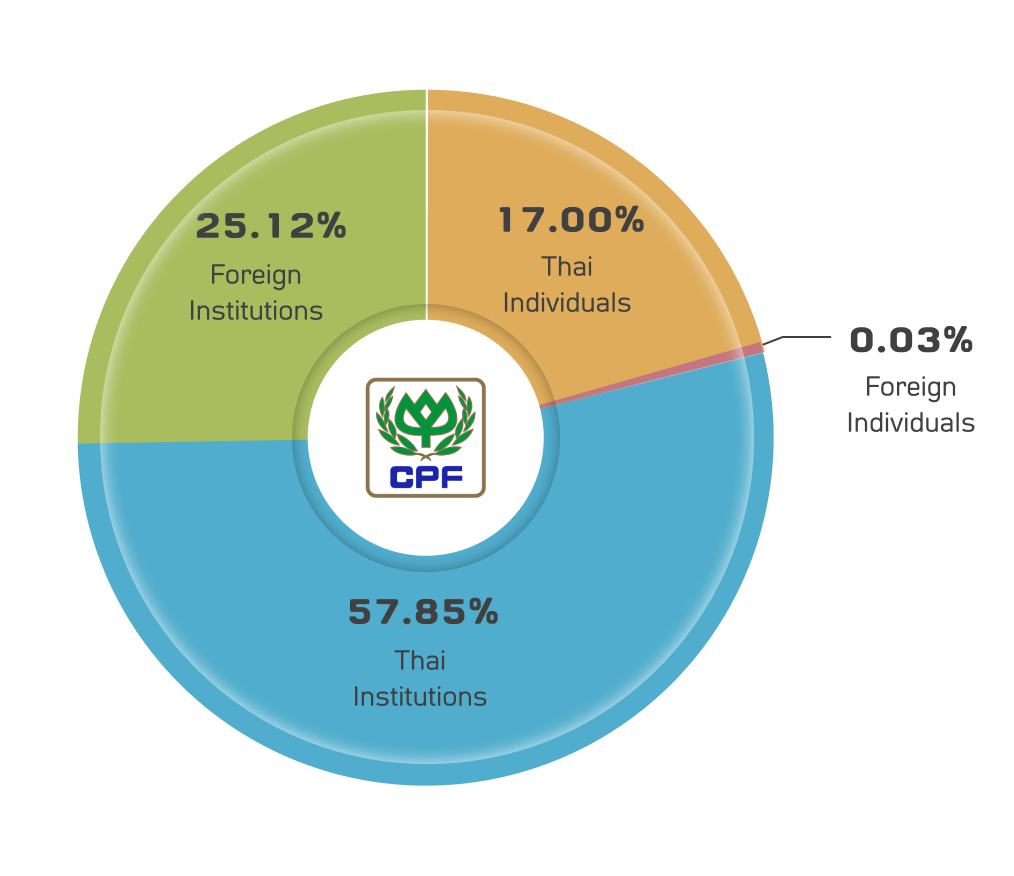

as of March 13, 2025

Note: Total issued and paid-up shares as March 13, 2025 = 8,413,568,585 shares

* Include 170,507,800 treasury stocks, representing 2.03%

Shareholder

Top ten major shareholders, number of shares and holding percentage on March 13, 2025 the latest record date.

| Name of Shareholders | No. of Shares | % Shareholding (before deduction of treasury stock(1)) |

| 1. CPG Group(2) comprises: | 4,162,127,539 | 49.47% |

| 1.1 CPG(3) | 2,105,464,925 | 25.02% |

| 1.2 Charoen Pokphand Holding Co., Ltd.(4) | 743,660,460 | 8.84% |

| 1.3 Jumbo Kingdom Ventures Ltd.(5) | 649,060,975 | 7.71% |

| 1.4 Orient Success International Ltd.(5) | 120,814,159 | 1.44% |

| 1.5 Worth Access Trading Ltd.(5) | 117,342,300 | 1.39% |

| 1.6 Bangkok Produce Merchandising Plc.(6) | 120,415,720 | 1.43% |

| 1.7 CP Foods Capital Ltd.(7) | 228,569,000 | 2.72% |

| 1.8 Plenty Type Ltd.(7) | 76,800,000 | 0.91% |

| 2. Thai NVDR Co., Ltd.(8) | 875,107,414 | 10.40% |

| 3. Social Security Office(9) | 254,458,600 | 3.02% |

| 3.1 Social Security Office(9) | 245,321,800 | 2.91% |

| 3.2 Social Security Office by UOB Asset Management (Thailand) Co., Ltd. | 9,136,800 | 0.11% |

| 4. STATE STREET EUROPE LIMITED(10) | 185,682,550 | 2.21% |

| 5. SOUTH EAST ASIA UK (TYPE C) NOMINEES LIMITED(10) | 180,213,554 | 2.14% |

| 6. Vayupak Fund(11) | 154,734,200 | 1.84% |

| 6.1 Vayupak Fund 1 by MFC Asset Management Plc. | 77,367,100 | 0.92% |

| 6.2 Vayupak Fund 1 by Krung Thai Asset Management Plc. | 77,367,100 | 0.92% |

| 7. UBS AG HONG KONG BRANCH | 123,855,600 | 1.47% |

| 8. Mr. Prinya Tieanworn | 103,300,000 | 1.23% |

| 9. Thailand Securities Depository Co., Ltd. for Depositors(12) | 73,390,306 | 0.87% |

| 10. QS Software Systems Co., Ltd.(13) | 60,500,000 | 0.72% |

CPG Group does not have any shareholding in no. 2-7 and 9-10

Note:

- (1)170,507,800 treasury stock or 2.03% of total issued and paid-up shares of CPF

- (2)CPG Group is a reporting group to be in compliance with Section 246 and Section 247 of the Securities and Exchange Act of 2535 (as amended)

- (3)Engaging in investment business as well as importing and distribution of chemical products and providing technical services. Top ten major shareholders of Charoen Pokphand Group Co., Ltd. (“CPG”) and % shareholding of such persons are as follows: Charoen Pokphand SJ Holdings Co., Ltd. 12.96%, Mrs. Somurai Jaruphnit 8.42%, Mr. Dhanin Chearavanont 6.48%, C.P. Holding (Thailand) Co., Ltd. 4.55%, Mr. Phongthep Chiaravanont 4.26%, Mr. Manas Chiaravanond 4.22%, Mrs. Somsri Lumsam 4.21%, Mrs. Nuchanart Chiaravanond, Miss Nalinee Chiaravanont, Mr. Nakul Chiaravanont, Mr. Nopadol Chiaravanont 3.00% each.

- (4)CPG’s direct subsidiary, engaging in investment business

- (5)CPG’s indirect subsidiary, engaging in investment business

- (6)CPF’s direct subsidiary, engaging in animal feed raw material distribution

- (7)CPF’s subsidiary, engaging in investment business

- (8)A Thai company, contact information: 93, 14th Floor, The Stock Exchange of Thailand Building, Ratchadapisek Road, Dindaeng, Bangkok 10400, Thailand, Thai NVDR Co., Ltd. issues Non-Voting Depository Receipt (NVDR) and offers to investors. NVDR investors are entitled to receive all financial benefits as if they invest in ordinary shares. However, NVDRs generally are not allowed to participate and vote in shareholders’ meetings except only in the case where the company wishes to delist itself from the SET.

- (9)A Thai government department, contact information: Siam Commercial Bank Plc., 17th Floor, Zone C (Markets Operations Division), 9 Ratchadapisek Road, Chatuchak, Bangkok 10310, Thailand

- (10)A foreign company, contact information: Securities Services Dept., 12th Floor, Standard Chartered Bank (Thai) Plc., 140 Wittayu Road, Lumpini, Pathumwan, Bangkok, Thailand

- (11)A Thai fund

- (12)A Thai company, contact information: 93, 14th Floor, The Stock Exchange of Thailand Building, Ratchadapisek Road, Dindaeng, Bangkok 10400, Thailand

- (13)A Thai company, contact information: 313 C.P. Tower, 14th Floor, Silom Road, Bangrak, Bangkok 10500, Thailand